Hey there! Running a great Wi-Fi network is often just another cost of doing business. But what if I told you it doesn't have to be? What if you could flip that expense into a new source of revenue? That's exactly where a smart payment gateway integration comes in, letting you monetize your guest Wi-Fi and offer premium access tiers.

Turn Your Wi-Fi From a Cost to a Revenue Stream

Let's be real—your Cisco and Meraki gear is a powerful asset. When you pair it with the right tools, you can go way beyond just giving out free access and start building valuable, paid experiences for your users. The trick is to combine a flexible captive portal with a secure, reliable payment system.

This isn't about slapping a paywall on everything. It’s about giving people choices that make sense for different situations and environments.

Think about the possibilities in different sectors:

- Education: A university could offer a free, basic connection for light browsing and email, alongside a paid, high-speed option for students who need to stream lectures or download massive research files.

- Retail: A shopping mall can provide complimentary Wi-Fi for all shoppers but also sell a premium package with faster speeds for store employees or event vendors who depend on a solid connection.

- Corporate BYOD: In an office, you might provide standard access for employees while offering contractors or long-term guests a dedicated, paid plan for guaranteed bandwidth on their personal devices.

Secure Authentication is the Foundation

Of course, you can't talk about monetization without talking about security. Offering a reliable paid service is impossible if you can't guarantee every connection is secure. This is where modern authentication solutions are absolutely essential.

Technologies like IPSK (Identity Pre-Shared Key) and EasyPSK are game-changers for managing access, especially in busy, high-traffic environments.

By using an authentication solution like Splash Access, you can create a smooth and secure captive portal experience. It manages the entire user journey, from login to payment, ensuring every transaction is handled safely.

This kind of setup does more than just protect your network; it builds trust with the people paying for the service. They get a seamless, reliable connection, and you get a new revenue stream from the infrastructure you've already invested in. It’s a win-win.

Getting Your Cisco Meraki Network Ready for Payments

Before you can start charging for Wi-Fi access, you need to lay the proper groundwork on your network. Think of it as prepping the foundation before building the house. Getting your Cisco Meraki setup configured correctly from the start is the key to a smooth and successful payment gateway integration.

Your first move is to dive into the Meraki dashboard. The critical step here is configuring your network to use an external captive portal. This one setting is what allows your Meraki gear to hand off the user login process to an outside service—in this case, Splash Access. It's the switch that unlocks all the powerful customization and monetization features you'll need.

Lock Down Access with Modern Authentication

In any modern setting—whether it's education, retail, or a corporate office with a Bring Your Own Device (BYOD) policy—security isn't just a feature; it's a necessity. You simply can't run an open network, especially when you're handling payments. This is where robust authentication solutions like IPSK (Identity Pre-Shared Key) and EasyPSK become absolutely essential.

These methods are a massive security leap from using a single, shared password for everyone.

- With IPSK/EasyPSK, every user or device gets its own unique key. This makes tracking usage a breeze and allows you to revoke access for a single user instantly if you need to.

- Imagine a university campus with thousands of students or a large office managing dozens of visiting contractors. That kind of individual-level control is vital for keeping the network secure and reliable.

To help you visualize what's needed, here’s a quick breakdown of the core components involved in setting up a monetized Wi-Fi system.

Key Components for Wi-Fi Monetization

A breakdown of the essential hardware, software, and services needed to enable paid Wi-Fi access on your network.

| Component | Role in the System | Example/Best Practice |

|---|---|---|

| Network Hardware | Provides the physical Wi-Fi signal and connectivity. | Cisco Meraki Access Points (APs) form the backbone of the wireless network. |

| Captive Portal | The "front door" for users, managing authentication and payments. | Splash Access serves as the external captive portal, managing the user journey. |

| Authentication | Securely verifies user identities before granting access. | IPSK or EasyPSK for assigning unique keys to each user or device. |

| Payment Gateway | Processes the financial transactions securely. | Stripe or PayPal integration to handle credit card and digital payments. |

Putting these pieces together correctly is what makes the whole system work seamlessly.

The Growing Demand for Secure Payments

Setting up this kind of secure, professional system is more critical now than ever. The global payment gateway market was valued at a massive USD 35.17 billion in 2024 and is expected to rocket to USD 152.26 billion by 2032. This incredible growth shows just how much everyone relies on simple, secure online transactions. If you're interested in the data, you can explore the full payment gateway market report.

Once you've got your Meraki dashboard configured and a solid authentication method in place, you're in a great position to move forward. For a refresher on the basics, you can always check out our guide on how to set up guest Wi-Fi effectively. With a properly prepared network, the actual payment gateway integration becomes much, much easier.

How to Get Stripe and PayPal Working with Splash Access

So, you've got your Cisco and Meraki network humming along. Now for the fun part: plugging in your payment gateways. This is the moment your Wi-Fi network starts its transformation from a simple amenity into a real revenue-generating asset. Let's walk through how to hook up Stripe and PayPal to your Splash Access captive portal. I promise, it's more straightforward than you might think.

Don't worry about getting bogged down in technical jargon. The Splash Access dashboard was built to make this process as painless as possible. The whole job really comes down to grabbing your API keys from Stripe or PayPal and dropping them into the right fields in Splash Access. These keys are basically a secure digital handshake, making sure every transaction is handled safely and ends up in your account.

The best part of this setup is its flexibility. Once connected, you can build out different pricing tiers for all kinds of situations, whether you're running a network for education, retail, or managing a corporate BYOD environment.

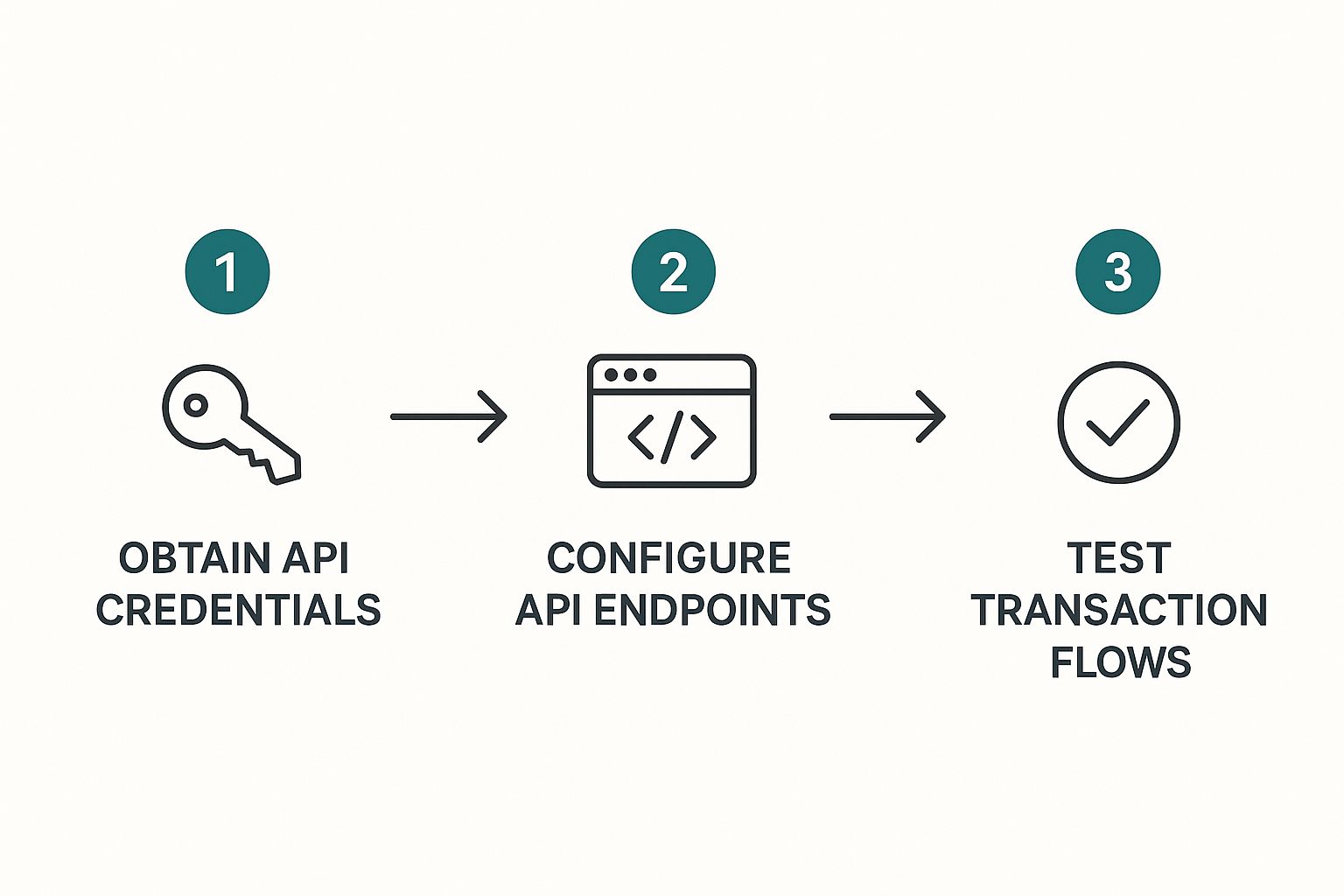

This quick visual breaks down the three main stages you'll go through.

As you can see, it’s all about getting your credentials, setting up the connection, and then giving it a thorough test run to make sure the user experience is rock-solid.

Finding and Using Your API Keys

First things first, you'll need to log into your Stripe or PayPal account. Buried in the account settings, you’ll find a section for developers or API access. This is your destination. For Stripe, you’re looking for a "Publishable Key" and a "Secret Key." If you're using PayPal, they're called the "Client ID" and "Secret."

Here’s a simple way to think about them: The Publishable Key is the public-facing piece that identifies your account on the captive portal page. The Secret Key is the behind-the-scenes workhorse that actually authorizes charges. It's critical to never share your Secret Key publicly.

With those keys copied, head back to your Splash Access dashboard and find the payment gateway section. You'll see fields labeled specifically for these keys. It's literally a copy-and-paste job. This is what forges the link between your network and your bank account.

Creating Practical Pricing Tiers

Once that connection is live, it’s time to define your access plans. This is where you can get creative and build offerings that make sense for your specific users.

I've seen some great examples out in the wild:

- Retail Center: A "Premium Shopper" plan for a few dollars gives vendors or serious shoppers unlimited high-speed access for the day. It’s a small price to pay for a flawless connection.

- University Campus: During exams, a "Finals Week Power-Up" plan can be a lifesaver, offering students guaranteed bandwidth for a week to stream lectures and do heavy research without a hiccup.

- Corporate Office: For contractors in a BYOD setting, a "Monthly Contractor Pass" is perfect. You can pair it with authentication solutions like EasyPSK for secure, dedicated access that lasts the duration of their project.

Jumping on this now is a smart move. Digital payment volume is exploding. Between 2020 and 2027, the total value processed by payment gateways is expected to leap from $22.09 billion to an estimated $87.44 billion. This trend shows just how essential these systems have become.

After setting up your plans, the last and most important step is to run a test. Connect to your own Wi-Fi network as a user would, choose a paid plan, and complete a transaction. This quick check ensures everything is working perfectly before you open the floodgates.

Designing a Captive Portal That People Actually Like to Use

A paid Wi-Fi system is only as good as its first impression. If your login page is confusing, ugly, or just plain clunky, you're going to lose customers before they even pull out their wallets. The whole point is to create a captive portal that not only works flawlessly but also feels welcoming and trustworthy.

Think about who's using it. It could be a university student running late for class or a shopper trying to find a deal in a retail center. They don't have time for a complicated process. Your portal is their first handshake with your network, and it needs to be a good one, especially when you're about to ask for their credit card details.

Nail Your Branding and Keep Communication Crystal Clear

Your captive portal shouldn't look like a generic, third-party tool. It needs to be a seamless extension of your brand. Using Splash Access, you can customize everything—the colors, the logo, the messaging—to match your organization's look and feel. This consistency is what builds immediate trust. People are far more willing to enter payment details on a page that feels official and polished.

Once you have the look down, make sure the language is just as clean. Ditch the technical jargon and speak like a human.

- Be Upfront with Pricing: Nobody wants to solve a math problem to figure out what they're paying. Put it right there in plain English: $5 for 24 Hours High-Speed Access.

- Give Simple Directions: Guide users with short, clear text. Think "Choose Your Plan" and "Enter Payment," not something overly technical.

- Make it Easy to Navigate: Buttons should be big, bold, and easy to tap, especially on a phone.

A well-designed https://www.splashaccess.com/wifi-captive-portal/ gets people connected quickly and confidently, which is exactly what you want.

Your Portal Must Be Mobile-First, No Excuses

Let's be real: almost everyone is going to be connecting to your Cisco or Meraki network with their phone. This means your portal can't just be "mobile-friendly"; it has to be mobile-first. It needs to be designed from the ground up for thumbs, not mouse clicks.

This is critical in a busy corporate BYOD setting where employees and guests expect a quick, painless login on their phones. The same goes for an education campus where students are constantly on the go. If the mobile experience is frustrating, you’ve already lost.

The goal is to make the entire journey—from seeing the Wi-Fi network to being fully online—feel completely effortless on a smartphone. A smooth login tells users you respect their time and know what you're doing.

At the end of the day, a fantastic user experience is the glue that holds your payment gateway integration together. It ensures that all the robust back-end security, like IPSK or EasyPSK, is matched with a front-end that's just as reliable and intuitive. By focusing on strong branding, simple language, and a mobile-first design, you'll build a portal that doesn't just make money—it makes people happy to connect.

Putting It All Into Practice: Payment Integration Scenarios

Let's move beyond the technical setup and look at how this actually works in the real world. A smart payment gateway integration is about more than just collecting money; it's about solving real problems for your users and creating new opportunities for your organization. I've seen these setups work wonders on Cisco and Meraki networks, and here are a few common scenarios where they truly pay off.

The key is to remember you're adding genuine value, not just a frustrating paywall.

The University Campus Upgrade

Think about a huge university campus during finals week. The standard free Wi-Fi is good enough for sending a few emails, but you've got thousands of students all trying to stream HD video lectures and pull down massive research files at the same time. The network grinds to a halt, and so does their studying.

This is where a simple Stripe integration on the captive portal becomes a lifesaver. The university's IT team can spin up a "Finals Week High-Speed Pass." For just a few dollars, a student can instantly upgrade to a premium tier with guaranteed bandwidth. It directly addresses a critical student need at the perfect moment, and the revenue generated can be put right back into improving the campus Meraki network.

The Retail Center VIP Experience

Now, let's head to a bustling shopping center. Most shoppers are perfectly fine with the free guest Wi-Fi for browsing social media. But the real tenants—the stores and pop-up kiosks—depend on a completely stable connection for their POS systems and inventory software. A dropped connection means lost sales.

By integrating PayPal, the mall management can create a "Vendor VIP" package. This is a monthly subscription that gives retailers their own dedicated, high-speed connection, often secured with an IPSK or EasyPSK key. Suddenly, the Wi-Fi network isn't just a cost center; it's a valuable B2B service that provides a rock-solid experience for businesses and a new income stream for the property.

A well-planned payment gateway integration lets you meet specific user needs right when they need it most. Whether it's a student desperate for a speed boost or a business that can't afford downtime, you're ready with a valuable, on-the-spot solution.

The Corporate BYOD Solution for Contractors

Finally, picture a large corporate headquarters with a tight Bring Your Own Device (BYOD) policy. Full-time employees are authenticated automatically onto the secure network, no problem. But what about contractors who are on-site for a three-month project? They need reliable, fast access, but you don't want to add them to your internal user directory.

This is a perfect use case for pairing an authentication solution like EasyPSK with a paid tier. Contractors can simply buy a "90-Day Project Pass" right from the captive portal. They get a unique key for their devices, which gives them the secure, high-performance connection they need to do their job. All the while, they remain safely segmented from the main corporate network, making onboarding and offboarding a breeze for IT.

These aren't just hypotheticals; this kind of flexible, subscription-based access is becoming incredibly common. Market forecasts show the global payment gateway market is expected to grow from USD 26.7 billion in 2024 to USD 48.4 billion by 2029, and this trend is a major driver. If you're interested in the data, you can discover more insights about the payment gateway market. From education to retail, the potential for a powerful return on investment is clear.

Common Questions About Wi-Fi Payment Gateways

When you start looking at integrating a payment gateway with your Wi-Fi, it's natural for questions to pop up. It’s a big move, after all, and one that can really change how you view your network. Let's walk through some of the things we hear most often from organizations setting this up on their Cisco and Meraki networks.

The main benefit here is pretty straightforward: you can turn your Wi-Fi from a cost center into a new revenue stream. Think about places like universities (education), shopping centers (retail), or even a large corporate BYOD environment. You can offer different levels of access—a free, basic connection for everyone, and a paid premium option for people who need more bandwidth. It's a great way to improve the user experience while offsetting your network maintenance costs.

How Does This All Work Together

The whole process is surprisingly seamless and completely automated. When someone connects to your Meraki Wi-Fi, they are immediately redirected to your custom Splash Access captive portal.

On that portal, they'll see the access tiers you've designed. Maybe it's a free 30-minute pass or a paid 24-hour premium plan for faster speeds. If they choose a paid option, the portal securely hands them off to your payment gateway to process the transaction. Once the payment is approved, Splash Access instantly grants their device access to the Cisco network for the duration they paid for.

The captive portal is the key. It acts as the friendly gatekeeper, managing the entire user journey from login and payment to final network access, ensuring everything is secure and simple for the user.

The Role of Secure Authentication

This is a great question: Do you really need authentication solutions like IPSK or EasyPSK to run a paid Wi-Fi service? While they don't handle the credit card transaction itself, they are absolutely crucial for securing your network after a user has paid.

Think about it, especially in busy BYOD environments you see in corporations and on campuses. You have to make sure every single connection is secure and tied to a specific device.

- IPSK and EasyPSK solve this by giving a unique key to each user, which helps prevent unauthorized access or someone trying to piggyback on a paid session.

- This kind of individual key management is what builds trust and lets you deliver a high-quality, secure service that people are happy to pay for.

It ensures that once a user pays, their connection is both protected and reliable. The payment gateway handles the money, and strong authentication handles the security. You can get a deeper look into how our system works by reading about our Splash Access payment features.